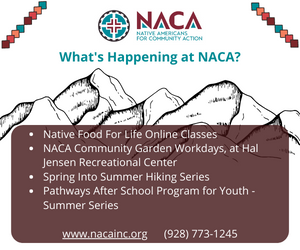

OneAZ Credit Union is excited to award $40,000 in grants to eight Flagstaff and Sedona-area non-profit organizations as part of its Community Impact Grant program. Each organization will receive $5,000 toward a program or initiative that supports one of OneAZ’s Five Pillars – Children’s Health, Food … [Read more...] about OneAZ Awards Thousands to Flagstaff-Area Non-Profits

OneAZ Credit Union

Business Line of Credit: How It Works, When It is Useful

Need help managing cash flow? A business line of credit may be the right option for you. A business owner can borrow as needed up to the limit of the approved credit line, which can range from $10,000 to $1,000,000, depending on the type of business. Business lines of credit with lower credit limits … [Read more...] about Business Line of Credit: How It Works, When It is Useful

Supporting Communities through Non-Profit Organizations

Arizona is home to more than 20,000 non-profits that provide services to people across the entire state. Non-profits in Arizona have a significant impact in helping make the state a better place to live. When a business or individual gives back, they are contributing to the prosperity … [Read more...] about Supporting Communities through Non-Profit Organizations

Four Ways to Support Local Businesses Affected by COVID-19

Locally owned businesses are facing unique challenges, likely unlike any they’ve encountered before. Even as Arizona gets back to business, many owners are finding that they need to quickly adapt to stay afloat in light of the COVID-19 pandemic. To keep Arizona’s economy strong, it’s more … [Read more...] about Four Ways to Support Local Businesses Affected by COVID-19

How Can You Improve Your Credit Score?

Your credit score is used by financial institutions and lenders to determine how much money you may borrow for a loan or credit card. A higher credit score may mean lower interest rates and better credit limits, while a low score could mean you get denied for credit. What does your score mean, and … [Read more...] about How Can You Improve Your Credit Score?

Navigating Small Business Lending Opportunities

Navigating as a small business owner can be daunting, especially during a pandemic. But with a little insight and planning, businesses can chart a smart course through uncertain times. Have lenders changed operations or lending procedures during the COVID-19 pandemic? Certainly, some lenders … [Read more...] about Navigating Small Business Lending Opportunities

How to Prepare for a Possible Recession

Arizona’s economy has taken a hit during the COVID-19 pandemic. Restaurants, retailers and more shut their doors or dramatically altered operations. Workers were let go or furloughed, bringing Arizona’s unemployment rate up to 12.9% in April (compared to just 4.4% in February) according to the … [Read more...] about How to Prepare for a Possible Recession

Rural Business Banking: More Options Than Ever

When you keep money local throughout the spending cycle, it works with you to strengthen the dollar and enhance the local economy. Rural businesses have traditionally been limited to large national banks for their comprehensive business services. All that has changed in recent years, however, with … [Read more...] about Rural Business Banking: More Options Than Ever

Five Ways to Keep Your Money Local

In the age of two-day shipping and convenient megastores, it’s easy to think that opting for a national brand is the best use of your money. However, supporting Arizona businesses and organizations means your money stays local, through taxes, investments and more. That means that your hard-earned … [Read more...] about Five Ways to Keep Your Money Local

What to Consider When Making a Balance Transfer

When you have high-interest credit card debt, making monthly payments can feel a lot like chipping away at a mountain with a hammer and chisel. If you’re paying the minimum each month, most of your money likely goes to the interest, meaning it can take years to make notable progress on the principal … [Read more...] about What to Consider When Making a Balance Transfer