If you don’t have 20 percent for a down payment – don’t worry! The high cost of living combined with steep purchase prices proves a challenge for many Flagstaff homebuyers to avoid paying mortgage insurance. What is mortgage Insurance? Mortgage insurance is simply an insurance policy that … [Read more...] about Understanding Mortgage Insurance

mortgage

Real Estate Professionals Point to Silver Lining

The Northern Arizona Association of Realtors (NAAR) recently released annual home sales figures for 2011. Comparisons of 2011 real estate home sales (including Flagstaff, Williams and Winslow) to the previous year revealed some good news for Northern Arizona. “There were lots of positives last … [Read more...] about Real Estate Professionals Point to Silver Lining

McCain-Rockefeller Amendment Passes Senate

The U.S. Senate today approved an amendment offered by Senators John McCain (R-AZ) and Jay Rockefeller (D-WV) prohibiting Fannie Mae and Freddie Mac executives from receiving future multi-million dollar bonuses as long as the government-backed mortgage companies remain in federal conservatorship. … [Read more...] about McCain-Rockefeller Amendment Passes Senate

Flagstaff Habitat for Humanity Seeking Volunteers

Habitat for Humanity of Northern Arizona was started in 1994 and is one of 2,000 affiliates throughout the world. We invite people of all backgrounds, races, and religions to build houses together in partnership with families in need. Through sweat equity, 1% down payment and a 0% interest … [Read more...] about Flagstaff Habitat for Humanity Seeking Volunteers

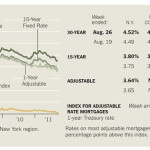

Refinancing While Under Water

In many cases, you can lower your interest rate even if you owe more on your home than it's worth. As low as they may be, I still don't think jumping into an adjustable rate mortgage makes sense. But, getting a six-percent rate or even a high-five-percent rate down into the four … [Read more...] about Refinancing While Under Water

Reclaiming the American Dream

In generations past, home ownership was a goal sought after by most families. Owning your own home with a yard, a picket fence, maybe a front porch is a cornerstone of the American dream. And building equity provided a path to the middle class, a way to finance college for the kids and build a … [Read more...] about Reclaiming the American Dream

Foreclosure Intervention Options for Troubled Borrowers

When President Barack Obama announced help for struggling homeowners in April 2009, millions of homeowners facing foreclosure or payment resets breathed a collective sigh of relief. What most of them didn’t expect was how much time, effort and paperwork would be involved, and how difficult it … [Read more...] about Foreclosure Intervention Options for Troubled Borrowers